2021年8月11日 日比谷中田 M&Aニュースレター Vol.18 (2021年8月号)

2021年8月11日(水)、日比谷中田 M&Aニュースレター Vol.18 (2021年8月号)を配信いたしました。

---- 目次 ----

1. お知らせ

2. 当事務所の最近の関与案件

3. 最新トピック「Warranties, Indemnities and Insurance in M&A」(文責 中田順夫、関口尊成 Getting the Deal Through – Practice Guides – Japan M&A掲載文書)

4. 所属弁護士の趣味紹介「メダカの屋外飼育」(文責 井上俊介)

1. お知らせ

■ 2021年7月1日付で、関口尊成弁護士(新60期)がパートナーに就任致しました。

■ 当事務所の弁護士によるセミナー情報をご案内します。

◆ テーマ:「アメリカM&A実務セミナー」

● 主催:日比谷中田法律事務所

● ゲストスピーカー:Ann-Marie McGaughey弁護士(Squire Patton Boggs Atlanta office)

● 講師:中田順夫 弁護士、太田香 弁護士

● 日時:2021年8月25日(水) 10:00~11:30

*本セミナーはオンライン会議システム「Zoom」で開催します

ご参加を希望される場合には、

https://us06web.zoom.us/webinar/register/WN_d9_jQmzITzy4HcDH4BJu2wまでお申し込みください。

お申し込みいただきました参加者には後日Zoomの招待URLをお送りいたします。

お申込み多数の場合には、抽選等により主催者にて参加受付者を決定いたします。

◆ テーマ:「国内・海外におけるM&A、表明保証保険の実務」

● 主催:企業研究会

● 講師:関口尊成 弁護士

● 日時:2021年8月26日(木) 10:00~12:30

● 会場:企業研究会セミナールーム

(東京都台東区東上野1-13-7 ハナブサビル)

*当日はオンライン配信も同時に実施します

【会場】 https://form.bri.or.jp/public/seminar/view/16722

【オンライン】 https://form.bri.or.jp/public/seminar/view/14945

◆ テーマ:「事業会社による国内・海外でのベンチャー出資の実務」

● 主催:企業研究会

● 講師:関口尊成 弁護士

● 日時:2021年9月13日(月) 14:00~17:00

● 会場:企業研究会セミナールーム

(東京都台東区東上野1-13-7 ハナブサビル)

*当日はオンライン配信も同時に実施します

【会場】 https://form.bri.or.jp/public/seminar/view/17621

【オンライン】 https://form.bri.or.jp/public/seminar/view/17622

◆ テーマ:「表明保証保険を活用した戦略的ディール管理~国内で使いこなすためのノウハウや秘訣などを、実践的に~」

● 主催:金融財務研究会

● 講師:関口尊成 弁護士

● 日時:2021年10月1日(金) 10:00~12:00

*本セミナーはオンライン会議システム「Zoom」で開催します

https://www.kinyu.co.jp/seminar_detail/?sc=k211831

◆ テーマ:「海外国内におけるCDMO企業(医薬品受託開発製造事業をおこなう企業)の買収のポイントと注意点」

● 主催:情報機構

● 講師:中田順夫 弁護士

● 日時:2021年10月7日(木) 13:00~15:30

*本セミナーはオンライン会議システム「Zoom」で開催します

https://www.johokiko.co.jp/seminar_medical/AB211038.php

2. 当事務所の最近の関与案件

現在継続中のM&A/JV案件として、アメリカ2件、イギリス2件、ドイツ1件、イタリア1件、フランス1件、オランダ2件、トルコ1件、中国3件、タイ1件、インドネシア2件、フィリピン1件、シンガポール1件、ベトナム1件、グローバル2件、国内9件など、多数進行中です。

3. 最新トピック「Warranties, Indemnities and Insurance in M&A」(文責 中田順夫、関口尊成(1) Getting the Deal Through – Practice Guides – Japan M&A掲載文書)

イギリスのLexologyという出版社が出しているGetting the Deal Throughシリーズとして今夏出版されたJapan M&Aからの抜粋です。前半(warrantiesとindemnity)が中田の執筆、後半(W&I insurance)が関口の執筆です。外国企業向けの書籍ではありますが、後半の国内表明保証保険の普及の最新動向に関する記載が皆様にも興味深いと思い、そのまま抜粋しました。

Japanese practice in share sale and purchase agreements – historical background and recent trends

In Japan traditionally mutual trust and credibility were most important for companies to maintain and expand business relationships with longstanding trading counterparties in the closed market. Once such mutual trust and credibility had failed through an inappropriate act by a company, the company would be disqualified and expelled from the market. Because of this tradition, even M&A transactions in Japan were conducted based on mutual trust and credibility rather than relying on legal contracts. At that time, the vast majority of sale and purchase agreements (SPAs) were very short and simple with insufficient protection for purchasers. However, for the past 20 to 30 years, Japanese companies completed M&A transactions in the United States and Europe and learned Western-style M&A practice, including the importance of legal contracts. In addition, the Japanese market is now much more open than previously to new joiners such as emerging Japanese companies and international companies. As a result, in many cases the counterparties in domestic M&A transactions in Japan are these new market joiners rather than longstanding traditional Japanese companies. For such M&A transactions, relying on legal contracts is natural and appropriate, and the SPAs have now become much longer and more detailed, with adequate protections for purchasers.

Nowadays, the style and content of SPAs for M&A transactions in Japan are quite similar to those in the US and Europe – and they are becoming more similar year by year.

Warranties for Japanese M&A

・ Overview

Formerly most Japanese M&A transactions were conducted on an ‘as is, where is’ basis, and broad lists of warranties in Japanese SPAs were rare, because at that time target companies in most M&A transactions were already very well known to the purchasers in the small and closed market. However, it is now quite common that thorough due diligence is conducted during the M&A process and a broader list of warranties is provided in the SPA. It is now the general understanding and belief in the Japanese market that, at least for listed companies, to secure appropriate and sufficient legal protection, including warranties in SPAs to hedge the risks associated with M&A transactions, is an obligation of the purchaser's management in light of the directors’ duty of care.

・ List of warranties

Following international standard practice, warranties in Japanese SPAs basically consist of:

・ those in relation to the seller (such as title to the shares, capacity to enter into the SPA, authorization given through all required corporate procedures, completion of all necessary filings and reports to the government, if any, and valid and binding effect of the SPA); and

・ those in relation to the target company (such as those regarding legal incorporation and existence, shares and other equities, financial statements, real and movable property, intellectual property, office lease and plant lease, bank borrowings, corporate bonds and notes, business agreements and activities, data protection, environmental issues, unfair competition, compliance with laws, officers and employees, outsourcing, labor union, pensions and benefits, IT systems, disputes and government proceedings and contingent liabilities, etc).

All exceptions to those warranties should be precisely listed and described in sufficient detail in the disclosure schedule to be attached to the SPA.

Indemnities for breach of warranty

・ Limitations

At present it is quite common in Japan to provide in the SPA:

・ the cap on the maximum total liabilities of the seller for indemnity for breach of warranty;

・ threshold or deductibles for the seller’s indemnity obligations to trigger;

・ de minimis to be counted for the threshold or deductibles; and

・ the time limit to raise a claim for indemnity based on breach of warranty.

These provisions depend on discussion and negotiation between the seller and the purchaser, but there is a market standard depending on the size of the transaction and the nature of the target company business (eg, if the target company is a heavy industry manufacturer, more environmental risk anticipated, and if it is an IT/technology company, IP infringement risk might be serious). Under the current Japanese market standard, the cap is somewhere between 10 and 40 per cent of the purchase price (the larger the purchase price, the lower the percentage of the purchase price for the cap) and the typical time limit in the Japanese market is 10 years from the closing date for the fundamental warranties, seven years from the closing date for the tax and environmental warranties and one to three years from the closing date for other general warranties. The market standard and actual risk found through due diligence will influence the negotiation between the seller and the purchaser.

・ Special indemnities

The facts that are in breach of warranties found during due diligence and known to the purchaser, and eventually specified by the seller in the disclosure schedule to be attached to the SPA, need to be specifically covered by special indemnities in the SPA, although if the amount of such special indemnity can be identified or agreed on or before the signing of the SPA, such issues will be treated as debt-like items and the amount identified and agreed will be simply deducted from the purchase price, rather than being covered by the special indemnity clause. As to special indemnities, the application of all the limitations for indemnities for breach of warranty, including the cap, threshold or deductible, de minimis and the time limit should be expressly excluded from the SPA (in line with international standard practice).

・ Sandbagging clause

In Japan the validity of a 'sandbagging' clause, namely, the provision in the SPA that even if the purchaser knew the breach of warranty on or before the signing of the SPA, the purchaser would still be entitled to claim indemnity against the seller for the breach of warranty, has not been tested by court precedents. On the other hand, there are some court precedents that confirmed the validity of an anti-sandbagging clause, namely, the provision in the SPA that if the purchaser knew the breach of warranty on or before the signing of the SPA, the purchaser would no longer be entitled to claim indemnity against the seller. In addition, where neither sandbagging nor anti-sandbagging clauses are provided in the SPA and the SPA is silent in this respect, there is a court precedent in Japan that the purchaser will not be allowed to claim indemnity against the seller as far as the purchaser knew, or should have known for gross negligence, the breach of warranty on or before the signing of the SPA. It is therefore advisable, when a purchaser knows the breach of warranty, that the purchaser should provide a special indemnity clause to cover this issue in the SPA, rather than simply relying on the sandbagging clause in the SPA, even if the sandbagging clause is successfully included in the SPA. Note, however, that in Japan such court precedents in the lower courts will not legally bind subsequent cases.

・ Necessity to expressly exclude the application of Japanese statutory law clauses

In order to achieve the same consequences as under international standard practice, with a breach of warranty the purchaser can seek indemnity against the seller only as provided and limited in the SPA, and the sale and purchase of the shares will not be avoided, rescinded, terminated or otherwise overturned. It is very important, especially on the seller side, that the application of the following Japanese statutory law clauses will be expressly excluded from the SPA:

・ termination for breach of agreement;

・ statutory liability for sale of defective goods;

・ misunderstanding; and

・ fraud.

・ Security measure for indemnity payment

Internationally, the escrow arrangement with a bank or notary public (depending on the country) as an escrow agent has been the most typical measure to secure future payment of the possible indemnity obligation of the seller for breach of warranty. However, in Japan escrow has not been commonly used, partly because of the general prohibition of deposit service under the Act Regulating the Receipt of Contributions, Receipt of Deposits and Interest Rates (Law No. 195 of 1954, as amended). Under this legal restriction, only trust banks, commercial banks and lawyers can be escrow agents, but few provide escrow service and it is not easy to find an appropriate escrow agent in Japan for M&A transactions.

Instead of escrow, instalment payments of the purchase price have been used for security, but in this case the seller may have concerns about the credit risk of the purchaser and the time, costs and difficulties of enforcing the purchaser to pay the outstanding purchase price. Warranty and indemnity (W&I) insurance, which has become more commonly used recently for Japanese domestic M&A transactions, should be the perfect solution.

Recent changes in W&I insurance in Japan

・ Past practice

While there are no public statistics, according to one of the leading insurance brokers in Japan, a W&I insurance policy appears to be purchased in around 10 per cent of Japanese outbound M&A transactions (ie, where a Japanese company acquires a foreign company). Japanese companies tend to take out a W&I insurance policy in auction deals in which a prospective bidder is required to take a W&I insurance policy. This arrangement is called ‘stapled insurance’ or ‘sell–buy flip’.

For Japanese outbound M&A transactions Japanese insurance regulations prohibit a foreign insurer from directly providing Japanese companies with an insurance policy. In practice, in these cases, a 'fronting’ arrangement is used, where a Japanese insurer provides W&I insurance on behalf of a foreign insurer, but transfers almost all risks to the foreign insurer by entering into a reinsurance contract.

On the other hand, W&I insurance has not been popular in Japanese domestic M&A transactions (ie, where a Japanese company acquires a target company in Japan). For domestic deals, an SPA and a due diligence report (DDR) are prepared, all in Japanese. However, Japanese insurers used to be reluctant to provide W&I insurance by using their own exposure and, accordingly, often arranged reinsurance in order to transfer almost all insurance risks to foreign reinsurance companies. This meant a foreign reinsurer doing underwriting on behalf of a Japanese insurer, with underwriting procedures implemented in English. This required a Japanese acquirer to prepare English translations of the SPA and DDR. Also, underwriting calls have to be made in English. As a result of this inefficiency, Japanese companies have seldom taken out a W&I insurance policy in a domestic deal.

・ Recent trends since 2020

Since 2020, some Japanese insurers, such as Tokio Marine & Nichido Fire Insurance Co Ltd (Tokio Marine), Sompo Japan Insurance Inc (Sompo Japan), Mitsui Sumitomo Insurance Company Limited (Mitsui) and Aioi Nissay Dowa Insurance Co Ltd (Aioi), started providing W&I insurance for Japanese domestic M&A transactions using their own exposure. This enables underwriting procedures, including reviewing an SPA and DDR and making underwriting calls, to all be implemented in Japanese from start to finish. This change makes W&I insurance more appealing to parties to M&A transactions in Japan. Private equity (PE) funds especially have become interested in W&I insurance and begun purchasing W&I insurance policies.

In addition to those insurers, AIG General Insurance Co Ltd (AIG) used to provide underwriting work in Japanese from time to time, and while it is not clear when such Japanese underwriting work might be available, this practice is seemingly still continuing.

Characteristics of W&I insurance in Japan

・ Non-US type

W&I insurance in Japan can be categorised as non-US type, typically prevalent in Europe and Australia. In particular, as with an underwriting call, questionnaires are shared with the insured in advance of the call. With an insurance policy, a cover spreadsheet is prepared, which clarifies which warranties in an SPA shall be covered, partially covered or excluded by the insurance policy. Further, de minimis is applicable to the insurance policy.

Japanese practice is non-US type, as in US-type representations and warranties insurance, questionnaires are not usually shared in advance, no cover spreadsheet is prepared and de minimis is not applicable to the insurance policy.

・ Unique characteristics

There are several unique features in Japanese practice. First, the minimum insurance premium that W&I insurers generally expect to charge is around ¥10 million. The minimum premium needs to be set so that an insurer can make sufficient profit to keep its business, considering various costs such as underwriting work. Therefore international insurance companies, regardless of whether US type or non-US type, are unlikely to target small M&A transactions.

However, this is not necessarily applicable in Japan. Japanese insurers target not only medium-sized or large M&A transactions, but also target small M&A transactions that international insurers have declined to accept because the expected premium is likely to be less than the assumed minimum premium level (ie, ¥10 million).

Japan has a significant issues with an aging society and a low birth rate, and many family businesses are currently struggling to find a successor. This has created a large demand for company succession M&A transactions, where another Japanese company, typically a bigger company, acquires and succeeds the family business. Owing to this demand, Japanese insurers are interested in these M&A transactions; since the purchase price or enterprise value tends to be small, it is expected that insurance premiums will become less than ¥10 million, taking into account a kind of volume discount strategy.

Japanese insurers are making special efforts to deal with these small M&A transactions. The basic concept is how to minimise underwriting costs. To do this, for example, Tokio Marine prepares the pre-fixed warranties clauses that the W&I insurance will cover. This arrangement is offered to a small M&A transaction where the purchase price or enterprise value ranges from ¥100 million to ¥1 billion. Tokio Marine’s pre-fixed warranties contain:

・ title to the shares;

・ material agreements;

・ employees;

・ litigation;

・ financial statements;

・ tax; and

・ disclosure.

The minimum premium is set at ¥3 million. A buyer is required to provide such warranties in the SPA to enjoy insurance coverage. Tokio Marine covers only the pre-fixed warranties even if there are other warranties in the SPA, which means that the other warranties will remain to be resolved between the SPA parties without relying on a W&I insurance policy. A cover spreadsheet is not prepared since there is only one choice of what Tokio Marine wants to provide as its insurance coverage. Sompo Japan takes a similar approach to Tokio Marine.

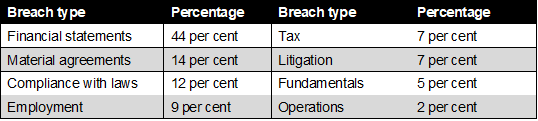

We have researched 31 recent court cases (where judgment was given up to December 2019), which are publicly available and deal with a claim for damages based on breach of warranty. The result is as follows:

Proportion of breach of warranty judgments by type

Tokio Marine’s pre-fixed warranties are in line with the above data. Tokio Marine seemingly sets the pre-fixed warranties taking into consideration this tendency in disputes.

Aioi takes a quite different approach from Tokio Marine, using sell-side W&I insurance, targeting a small M&A transaction where its purchase price or enterprise value is less than ¥200 million. Aioi simplifies underwriting processes by offering pre-fixed warranties that are basically overwrapped by Tokio Marine’s. Aioi does not require a vendor or buy-side DDR from a seller for underwriting work, and this helps Aioi save costs and time. Although the minimum premium is not clearly published, Aioi refers to the possibility that the premium may be ¥2 million where the purchase price or enterprise value is ¥200 million. Mitsui issued a press release to declare that Mitsui will also provide a sell-side W&I insurance policy that targets small M&A transactions, and its minimum premium is ¥3 million.

Buy-side W&I insurance

Although there are no statistics owing to insufficient precedents, W&I insurance premiums will be 2 to 3 per cent of the limit of liability in an insurance policy, retention will be 0.5 to 2 per cent of the purchase price or enterprise value and de minimis depends on the de minimis of an SPA and threshold DDR sets. A policy period for general warranties is often set at three years after completion date, and the periods for fundamental and tax warranties tend to be six to seven years after the completion date. Subrogation is limited to cases where there is seller fraud and wilful default, as in international practice.

As with the pre-fixed type of buy-side W&I insurance provided by Tokio Marine and Sompo Japan, there is no public reference to the terms and conditions in detail, while at least the insurance premium should be more attractive than with a typical buy-side W&I insurance policy.

Sell-side W&I insurance

Sell-side W&I insurance has not usually been used to date in Japan. However, as with the pre-fixed type of sell-side W&I insurance provided by Aioi, Aioi indicates that the premium could be 1 per cent of enterprise value.

Exclusion

Exclusions are in line with international practice, and typically include fraud, knowledge, disclosure, price adjustment, forward-looking statement, asbestos, pollution and product liability.

Among them, as with disclosure, there are two ways to exclude what is disclosed by the seller to the buyer in international practice. US-type W&I insurance excludes what was disclosed in the disclosure schedule. On the other hand, the non-US type excludes what was disclosed during the due diligence, regardless of whether such information is specified in the disclosure schedule. This difference is linked to the SPA provisions. A disclosure schedule often constitutes a US-type SPA. This is sometimes not so with a non-US-type SPA, which tends to permit broader seller liability exemption. Even if an item is not referred to in the disclosure schedule, the seller may be exempted where such item is disclosed in the due diligence process, including disclosure via virtual data room (VDR). A Japanese SPA often does not refer to either type of exemption mechanism. Accordingly, there is no strong logical link when deciding which disclosure mechanism to select in relation to the insurance policy. However, as in non-US-type W&I insurance, Japanese insurers currently tend to exclude what was disclosed during the due diligence regardless of whether such information is specified in the disclosure schedule.

Underwriting process

・ Buy-side W&I insurance

There are three major insurance brokers in Japan: Marsh Japan Inc, Aon Japan Ltd and Willis Japan Services KK. When they are retained, they start preparing a non-binding indication (NBI). Insurers are usually required to provide their NBIs to an insurance broker within three business days. Then the broker prepares an NBI report for its client. An NBI report elaborates on each insurer’s NBI, including coverage and other key comparative metrics such as expected breadth of coverage position, premium, retention and de minimis.

Then the insured decides which insurer it will work with and requests to start underwriting work. Underwriting fees are paid as agreed between the insurer and the insured (in an expense agreement or service agreement). Some Japanese insurers make it clear that they do not charge underwriting fees depending on the purchase price or enterprise value of the target company. Counter-intuitively, underwriting fees tend to be exempted in small M&A transactions in Japan. For example, Tokio Marine states that if the purchase price or enterprise value is less than ¥5 billion the underwriting fees will not be charged. This demonstrates the tendency of insurers in Japan trying to adjust traditional W&I insurance to the small M&A market.

Once underwriting has been initiated, the processes are almost the same as in typical non-US-type W&I insurance. It takes two to four weeks to complete the whole underwriting process and reach final agreement on an insurance policy between the insurer and the insured. First, the insured gives the insurer’s underwriting team, in addition to an SPA, access to VDR and DDR on condition that the insurer submits non-reliance letter to the advisers. The underwriting team sends the questionnaires, which constitute general and specific questions, to the insured after reviewing the VDR and DDR. The insured completes the questionnaires and has an interview ('underwriting call') with its advisers (ie, lawyers and accountants engaged in due diligence of a target company). Then the insurer prepares a policy draft, including a cover spreadsheet. A cover spreadsheet is attached to the policy, distinguishing clause by clause which warranties in the SPA are covered, partially covered or excluded.

According to one insurance broker, many M&A lawyers are not yet familiar with W&I insurance, and owing to this lack of experience insurance coverage has sometimes been less than it should. Therefore it is crucial to retain lawyers experienced in this area.

・ Sell-side W&I insurance

Sell-side W&I insurance has not been popular to date, so there are no procedural precedents. Aioi is expected to establish its own practices. As mentioned, Aioi provides concise sell-side W&I insurance, where it does not require a vendor DDR for an SPA seller for underwriting work. Although it is not clear exactly what practices Aioi will create, it may request VDR or some scope of documents for its underwriting work. Some kind of questionnaire or underwriting call to the seller may be also implemented.

Stapled insurance

・ The rise of stapled insurance

The amount of stapled insurance has been increasing globally, where a seller, often a PE fund in an auction process, requires a buyer to purchase a buy-side policy to limit a seller’s exposure by providing alternative recourse. There are two types of stapled insurance, ‘hard staple’ and ‘soft staple.’

One of the biggest differences between hard and soft staple is who is supposed to select an insurer. In a hard staple, the seller selects an insurer based on an NBI report an insurance broker prepares. The insurer then undertakes pre-underwriting work, including reviewing vendor DDR and VDR. After that, an initial policy draft is provided to the seller. The seller shares this policy with a prospective bidder, together with a draft SPA. Then the bidder negotiates with the insurer with such a policy and makes a confirmatory underwriting process, using the bidder’s DDR and updated VDR. A hard staple requires that the prospective bidder takes W&I insurance to make an M&A transaction.

In a soft staple, a seller obtains an NBI report from an insurance broker and shares it with the buyer, who will select which insurer to purchase insurance from. A soft staple allows the buyer to decide whether to take insurance and from which insurer to purchase it. Sharing the draft SPA with a prospective bidder is the same as with a hard staple.

As Willis Towers Watson points out, a hard staple is usually a 'take it or leave it' approach.(2) This means that ‘the seller warranty package is only available if a buy-side W&I insurance policy is purchased’. On the other hand, ‘a soft staple permits the buyer to decide ultimately whether to contract insurance or assume residual transaction risk and usually limited resource’.

・ Non-recourse

Non-recourse is often used together with stapled insurance. Non-recourse means that the only recourse for a buyer is a W&I insurance policy, unless there is seller fraud or willful misconduct. If the seller requires a non-recourse arrangement as a mandatory condition, then a prospective bidder has no choice but to purchase W&I insurance so as to make a deal with the seller. Therefore, if a non-recourse arrangement is required, the buyer generally chooses to purchase a buy-side W&I insurance policy even if it is a soft staple, which does not force a buyer to take it out.

・ Current practice in Japan

In Japan, stapled insurance has not been prevalent. However, PE funds have started using stapled insurance, including hard staple. It is expected that such stapled insurance arrangements will increase and this will make W&I insurance more popular in Japan.

Footnotes

(1) Nobuo Nakata is a representative partner and Takanari Sekiguchi is a partner with Hibiya-Nakata

(2) 'Use of Transactional Risk Insurance and "W&I Stapling" is on the rise despite a slowdown in the global M&A markets', https://willistowerswatsonupdate.es/riesgos-corporativos-y-directivos/transactional-risk-insurance-wi-stapling/

4. 所属弁護士の趣味紹介「メダカの屋外飼育」(文責 井上俊介)

コロナ禍で在宅時間が増えたのを機に、春ごろから、ベランダでメダカを飼い始めました。本格的なアクアリウムとなると、機材も高価で、エサ遣りや掃除の手間もあるため二の足を踏んでいたのですが、メダカの屋外飼育であれば、手軽に始められ、お世話も比較的楽と聞き、それならば、と思ってはじめてみたものです。

いざ始めてみると、睡蓮鉢の中をすいすいと泳ぐメダカを眺めるのは楽しく、時間がたつのも忘れてついつい見入ってしまいます。エサを求めているだけなのでしょうが、人が近づくと水面に集まって口をパクパクさせ、まるで懐いているようです。飼い始めてしばらくすると、針子と呼ばれるメダカの赤ちゃんが水面に見られるようになりました。一センチにも満たない針子がたどたどしく泳ぐ姿は何とも愛らしいものです。針子はそのままだと成魚に食べられてしまうこともあるそうで、別の水槽に避難させたところ、のびのびと大きく育っています。目下の課題は、この酷暑です。人間同様、メダカも暑さには弱いようなので、睡蓮鉢の傍らに背の高いオリーブの鉢を置いて日陰を作ったり、打ち水をしたりして、無事に夏を乗り越えてくれることを願っています。

このように楽しいメダカ飼育ですが、メンテナンスも室内飼育に比べて簡単です。飼育数が適正で水量が十分であれば、水面を撫でる風や水草の光合成により供給される酸素だけで足りるので、エアポンプはいりません。また、メダカと一緒に睡蓮鉢に入れているタニシやエビ、それから水中のバクテリアがメダカのフンや食べ残しを分解し、水草の栄養に変えてくれるため、ろ過や水替えも基本的に不要です。さらに、メダカは、水面に落ちた虫や水中の微生物を食べるためエサも最小限で済みます。水が蒸発して減ってきても、雨が降れば元に戻ります。このように、できる限り自然に任せることにより、睡蓮鉢の中にメダカを中心とした小さな生態系を作り出すことが屋外飼育の醍醐味だと思います。こういう形の屋外飼育をビオトープと呼ぶこともありますが、我が家の場合、最小限の人の手は入っているので、差し詰めビオトープ”風”といったところかと思います。

メダカも生き物ですので、時には死んでしまうこともあります。死んだメダカを見つけたら丁寧に弔ってあげますが、たまに、メダカの数が減っているのに死骸が見つからない時もあります。これはどうやらタニシやエビがいつのまにか死骸を食べているからのようです。こうして食べられたメダカは、やがて消化・排泄され、それが微生物のエサとなり、さらにその微生物がまた別のメダカに食べられ……というように、睡蓮鉢の中で循環が繰り広げられていることが想像されます。これを、メダカを構成する有機物の視点で考えてみると、ある時はメダカとなり、ある時はタニシとなり、またある時は水中を漂う微生物となり、というように、さながら睡蓮鉢の中で変身を繰り返しているかのようです。翻って睡蓮鉢の外を顧みると、我々もまた、睡蓮鉢のメダカと同じように、有機物の取りうる諸相の一つにすぎないことを思い知らされます。事程左様に、メダカの飼育というのは、いろいろな想像を掻き立てる、興味深いものであると感じています。

以上

日比谷中田法律事務所

------------------------

■ 配信停止、新規配信のお申し込みはこちら

newsletter@hibiya-nakata.com

■ お問い合わせ先

日比谷中田法律事務所

◆中田 順夫 代表パートナー 弁護士

Tel: 03-5532-3110(直通)

E-mail: nobuo.nakata@hibiya-nakata.com

◆水落 一隆 パートナー 弁護士

Tel: 03-5532-3109(直通)

E-mail: kazutaka.mizuochi@hibiya-nakata.com

〒100-0011

東京都千代田区内幸町2-2-2富国生命ビル22階

https://hibiya-nakata.com

※本ニュースレターは、クライアントの皆様への一般的な情報提供を目的とするもので、法的アドバイスを提供するものではありません。個別案件については当事務所の弁護士までご相談ください。